In early 1970s America, consumers were hesitant to use payment cards because of how prevalent it seemed to be for merchants to take advantage of them by inflating prices or adding extra charges to their bills. In response to growing public outcry, in 1974, lawmakers passed the Fair Credit Billing Act, which attempted to address these issues by creating chargebacks that would place some of the control of these transactions back in the hands of consumers. For the most part, this proved highly effective and led to the explosion of credit card usage throughout the rest of the 1970s.

Chargebacks are still a vital mechanism today, especially in ecosystems like the short-term rental industry, which sees millions of daily transactions. Today, the average chargeback to transaction ratio is 0.60% across all industries, which translates to 6 out of every 1000 transactions being a chargeback. That may seem like a negligent number, but when accumulated globally, chargebacks translate to $40 billion in losses to businesses worldwide every year.

So what exactly is a chargeback?

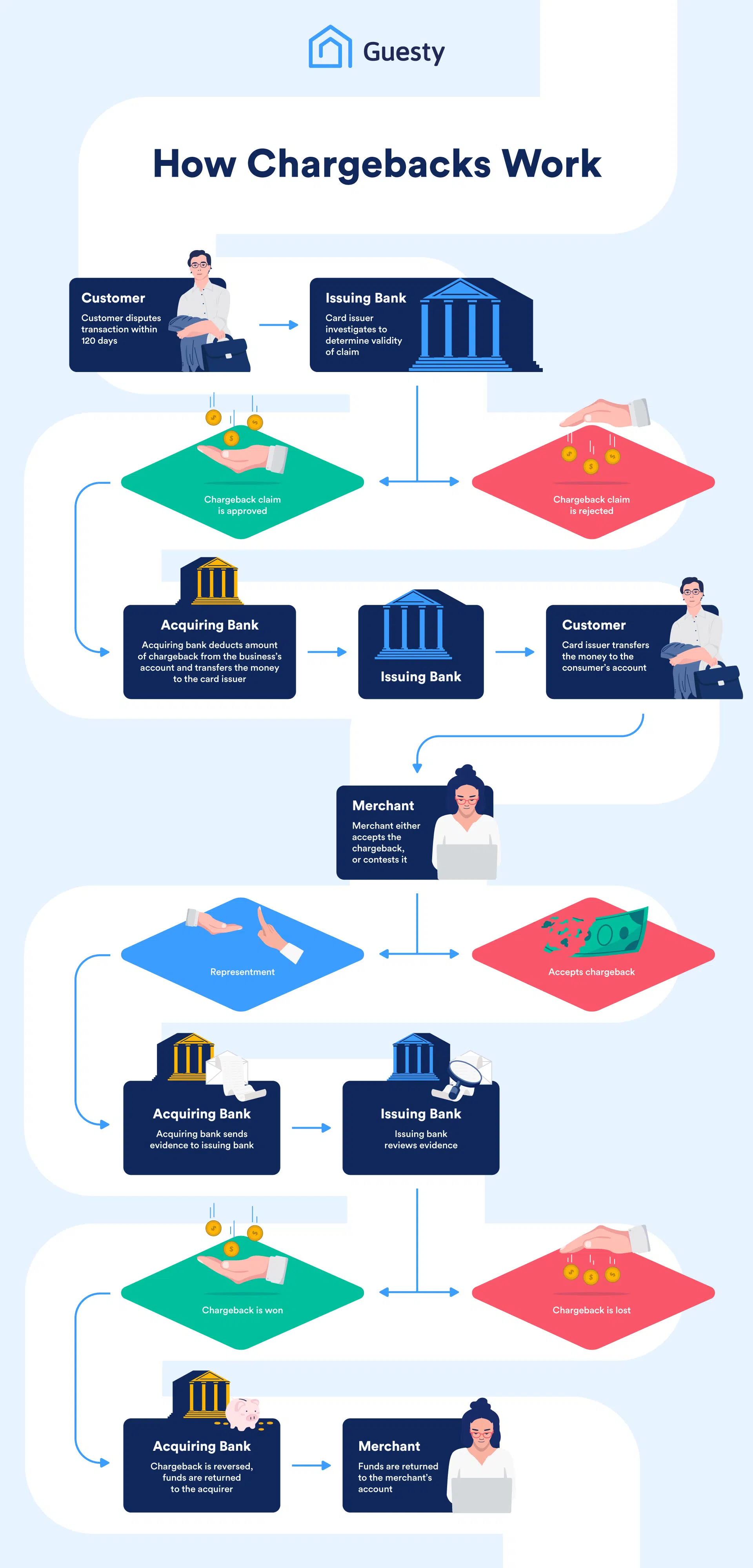

(Scroll down to see the chargeback process infographic)

A chargeback is the reversal of a payment made by a client to a merchant and is completed by the card issuer, which sends the funds back to the customer’s original payment method.

There are many reasons for a chargeback, with over 100 reason codes listed across the four major credit card brands. The main ones are:

- Customer disputes

- A refund not received by the customer

- Friendly fraud

- Buyer identity fraud

The most common reason for chargebacks is customer disputes, which could stem from the customer being unclear on the merchant’s refund policies or not knowing how to request a refund altogether. It could also arise from the customer not being satisfied with the product or service received (e.g., it is damaged or not delivered as advertised) and not taking this up directly with the merchant.

In terms of a refund; Once the merchant agrees to refund a customer, it should be granted within three business days. If it is not, the customer is entitled to submit a chargeback request to receive the funds.

Friendly fraud happens if the customer attempts to get their money back in bad faith after already paying the merchant for a product or service. In other words, customers may attempt to get their money back even if there is nothing wrong with the product or service. They are going against the very nature of what chargebacks were originally intended to do and so are abusing the process. Customers can get away with this because it can often pass the requirements for a legitimate chargeback request, which points to how the chargeback process favors the customer over the merchant.

Buyer identity fraud occurs when a customer uses someone else’s information to purchase a product or service. In this case, the person whose information was stolen will submit the chargeback request. This often results in the cardholder’s credit card being shut down and a new one issued as the original one has been compromised, and there is an increased chance of a repeat fraudulent transaction.

The chargeback process goes as follows:

- If the customer is unable to resolve a dispute with a merchant, they must contact their card issuer and request a dispute to be registered against the charge. They have 120 days following the initial purchase/payment to make this request.

- The card issuer investigates the dispute and decides whether there are grounds to the customer’s complaint.

- If the issuer approves the chargeback, they will forward the dispute to the acquiring bank (the merchant’s bank) to debit the funds from the merchant’s account.

- The acquirer then sends the dispute to the merchant to dock the funds from their account.

- Finally, the funds are transferred to the card issuer and subsequently to the customer’s account.