Executive Summary

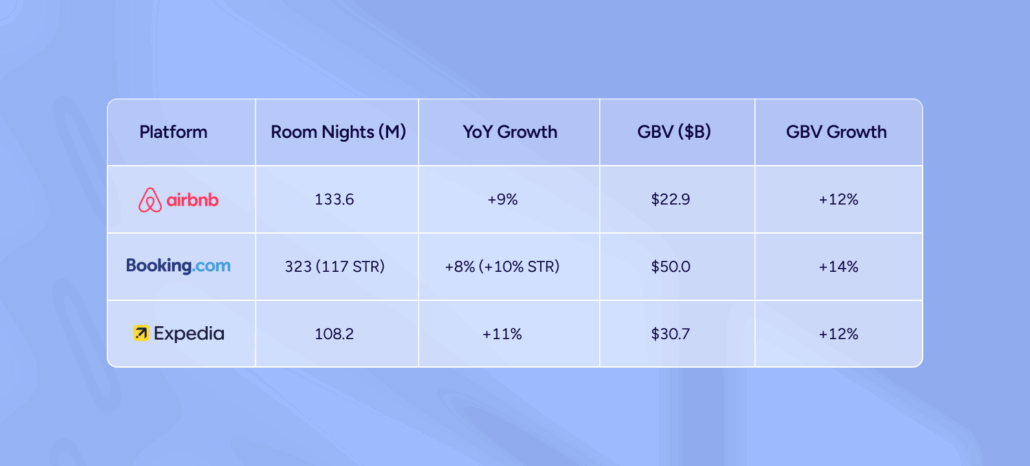

- Global demand for short-term rentals surged in Q3 2025: gross booking value rose ~12–14% YoY, and room nights across top platforms jumped 8–11%.

- Growth is increasingly coming from rising travel in Asia-Pacific (APAC) and Latin America — those regions posted double-digit expansion, while North America grew only modestly (low-to-mid single digits) as the market matures.

- On the supply side: Alternative accommodations (short-term rentals, not traditional hotels) gained serious momentum — for example, Booking.com’s “alternative accommodations” hit 117 M nights (36% of its total nights) and its listing base grew ~10% year-over-year.

- For property managers/hosts, this shift means: you’re entering a new phase — mature markets require focus on differentiation, quality, guest experience, and smart revenue management; while growth markets offer expansion and volume opportunities.

Q3 2025 revealed a clear geographic shift in global travel distribution. The world’s largest online travel agencies posted their strongest quarterly performance of the year, but the real story isn’t in the aggregate numbers: it’s in where those bookings are coming from.

Airbnb, Booking.com, and Expedia collectively exceeded analyst expectations, with room nights climbing 8-11% year-over-year. Yet this growth is increasingly concentrated in Asia-Pacific and Latin America, where double-digit expansion has become the norm. Meanwhile, North American bookings have settled into a steadier cadence, growing in the low-to-mid single digits as the market matures beyond its post-pandemic recovery phase.

For property managers, this geographic divergence carries immediate implications. Markets that drove growth for the past several years are entering a more mature phase, requiring different operational approaches focused on quality and differentiation.

Q3 2025 landscape: Growth accelerates with clear regional winners

Growth rates accelerated from Q2 across most platforms, with gross booking value climbing 12-14% year over year.

Expedia led on room nights growth (+11%). Booking.com’s alternative accommodations hit 117 million nights (36% of platform volume), outpacing hotel growth for the eighth straight quarter.

Airbnb: Asia-Pacific drives diversification

International markets pulled decisively ahead. Asia-Pacific posted mid-teens growth (Japan domestic nights +20%, South Korea hit record first-time bookers). Latin America matched that pace at high-teens (Brazil +30% in new users). Europe added mid-single digits. North America maintained steady growth in the low single digits as the market continues to mature.

Average daily rate hit $171 (+5% YoY, +3% ex-FX). North America saw +2%, driven by urban and cross-border mix shifts. Asia-Pacific climbed 3%.

Active listings jumped 17% year-over-year (concentrated in LATAM and APAC), even though Airbnb removed 600,000 low-quality listings since 2023. The Co-Host Network now supports 120,000 listings.

Services and Experiences gained traction: 80,000+ host applications, 4.9-star average rating. Notably, 45% of bookings came from locals, suggesting Airbnb is tapping demand beyond traditional travel.

Airbnb launched its Reserve Now, Pay Later capability and saw strong uptake, with 70% of U.S. users choosing the option in Q3. The company plans to extend this payment flexibility to additional countries in 2026.

Booking.com: Multi-vertical strategy produces measurable returns

The alternative accommodations segment demonstrated strong momentum on both supply and demand sides. Nights rose 10% to 117 million, now representing 36% of total platform volume. This growth outpaced traditional hotel accommodations, marking the continued expansion of short-term rentals in the hospitality industry. The platform now hosts 8.6 million alternative accommodation listings (up 10% year over year), showing that host supply also continues expanding. Booking.com also improved payment processing infrastructure to make transactions faster and simpler for property managers.

The Connected Trip initiative showed measurable traction, with these bundled bookings growing mid-twenties percent and now representing a low double-digit share of total transactions. Flight bookings jumped 32% while attraction bookings surged 90%. This multi-vertical approach creates stickier customers who are less likely to comparison shop once they’ve assembled their complete trip within Booking.com’s ecosystem.

Regional performance demonstrated the platform’s geographic diversification. Asia delivered low double-digit growth, confirming its position as the fastest-expanding region for Booking.com. Europe added high single digits despite being a mature market, while the U.S. improved to high single digits from Q2’s slower pace. American consumers continued showing caution with shorter stays and slightly lower rates, though the sequential improvement signals stabilizing demand patterns.

The Genius loyalty program continues driving engagement, with Level 2 and 3 members accounting for mid-50% of total nights. Booking.com is now extending Genius perks beyond accommodations into flights and attractions, using loyalty to drive cross-vertical bookings. On the technology front, AI deployment expanded across all brands, with Booking.com joining OpenAI’s ChatGPT App Store as one of the first travel integrations.

Expedia: Technology stabilization unlocks growth

Expedia completed its multi-year technology migration earlier in 2025, and Q3 results showed the payoff with improved conversion rates across all brands and faster feature deployment capabilities.

Vrbo continued facing U.S. headwinds with slightly lower rates and shorter stays, but new features are driving success. Conversion improved sequentially thanks to product upgrades including multiunit supply additions and streamlined booking flows. Over 20% of Q3 bookings used partner-funded promotional rates, a spring 2025 capability that gives hosts more control over demand generation.

Beyond Vrbo’s progress, Expedia’s vacation rental strategy extends across multiple brands. Hotels.com and the flagship brand are both growing STR supply and bookings, creating multi-brand distribution opportunities. This diversified approach is supported by Expedia’s technology investments: AI integration expanded across property Q&A, review summaries, and customer service, with virtual agents now handling over 50% of queries while reducing costs.

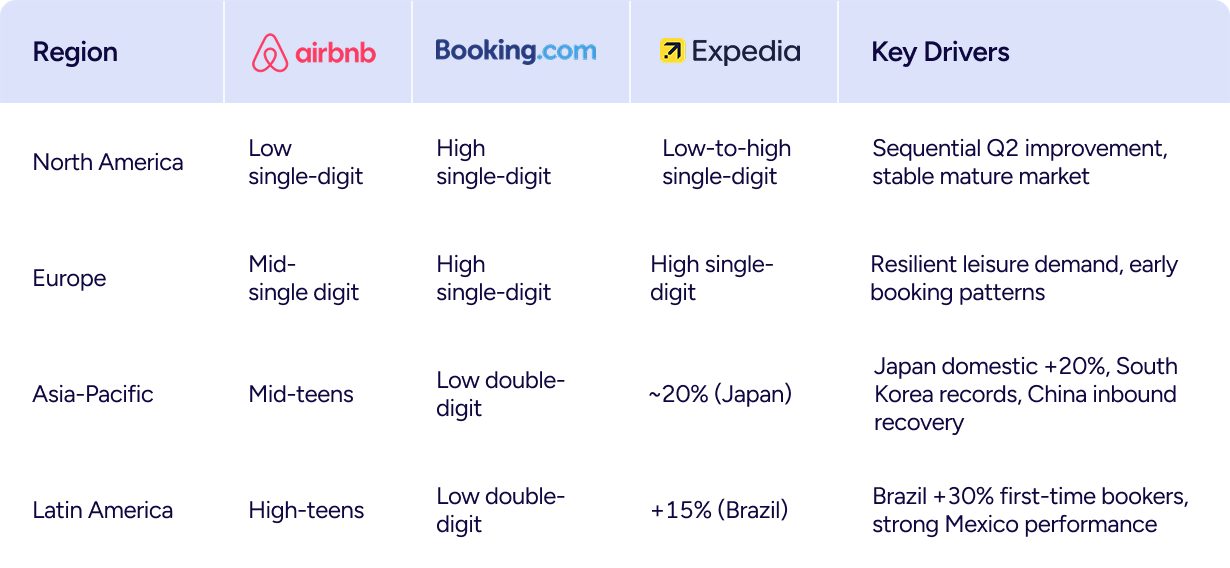

Regional analysis: Growth concentrates in Asia-Pacific and Latin America

Q3 confirmed distinct regional performance patterns, with Asia-Pacific and Latin America leading growth across all platforms.

Regional growth performance across platforms

- North America posted steady growth in the low single to high single digits, showing sequential improvement from Q2. This more mature market continues to provide a stable foundation, with success increasingly driven by operational precision: smarter pricing, refined operations, and elevated guest experiences.

- Asia-Pacific led with low-to-mid twenties expansion. Japan hit +20% across multiple platforms, South Korea set records, Southeast Asia and China stayed strong. APAC has led Airbnb’s growth for seven consecutive quarters.

- Latin America matched APAC at high-teens growth. Brazil led everywhere (Airbnb +30% first-time bookers, Expedia +15% overall), with Mexico and other markets posting strong numbers.

Travel corridors shifted notably, as Booking.com highlighted surging Canada-to-Mexico and Europe-to-Asia bookings. Cross-border travel accelerated, especially within and toward APAC. Booking windows normalized from early 2025’s extended lead times, though European travelers still book earlier at higher prices than cautious U.S. consumers.

Strategic imperatives for property managers

Align with platform priorities

Airbnb’s Services push (45% local bookings, 80,000+ host applications) generates more local activity that can benefit urban properties. Hosts near experience hubs or in neighborhoods with high local engagement may see extended guest stays and increased booking frequency as Airbnb embeds itself deeper into local routines beyond traditional accommodation. While Services are booked separately, the increased platform activity in urban areas creates opportunities for properties positioned near popular local experiences.

Booking.com’s Connected Trip growth favors properties near transportation and attractions. Optimize listings with specific distances to airports, stations, and sites. Show how your property serves multi-day itineraries.

Expedia’s multi-brand vacation rental strategy extends beyond Vrbo to Hotels.com and the flagship brand. Multi-channel distribution makes managing these listings manageable without duplication.

Tailor revenue strategies to regional dynamics

North American properties need operational precision in this mature market. Deploy dynamic pricing tools for quick response to demand shifts and booking pace. Invest in quality, photography, and guest experience optimization to drive premium-rate reviews.

International properties can maintain stronger pricing given APAC and LATAM momentum, but watch supply: Airbnb listings grew 17% YoY in these regions. Use revenue management tools to balance supply and demand dynamics.

Prioritize quality to match platform standards

Airbnb’s data proves it: Superhost bookings jumped 12% YoY, Guest Favorites generated 400M nights, and 600K low-quality listings got removed. High standards equal better placement.

Audit operations against platform criteria: response times, cancellations, reviews, photos. Operational management tools help maintain consistency. These metrics determine visibility more than ever.

Adopt automation to stay competitive as platforms deploy AI

Platforms are using AI to reshape search, recommendations, and guest service. Property managers need automated tools to keep pace with these changes.

Make listings AI-ready with comprehensive descriptions, detailed amenities, and quality photos. AI systems surface properties based on content quality, and incomplete information hurts visibility.

Use consolidated analytics to track performance across platforms. Each OTA emphasizes different success metrics (Airbnb’s Superhost status, Booking.com’s Genius participation, Expedia’s conversion rates). Integrated dashboards let you monitor all these metrics in one place to identify which platforms and strategies drive the best results.

Optimize for mobile booking behavior

Mobile drives the majority of bookings (Airbnb 62%, Booking.com mid-50s). Ensure mobile-friendly photos, scannable descriptions, and frictionless flows.

Flexible payment options gain traction

Flexible payment features saw strong adoption in Q3. Seventy percent of U.S. Airbnb users chose the platform’s Reserve Now, Pay Later option, which Airbnb plans to expand to more countries in 2026. This shift shows travelers value payment flexibility, particularly in markets where consumers are managing discretionary spending carefully.

Platforms are diverging in their strategies. Airbnb pushes into services and experiences, Booking.com builds Connected Trip, Expedia stabilizes technology while Vrbo recovers. Each creates distinct opportunities for property managers.

Success requires different approaches by market. Hosts need operational excellence through better pricing and quality differentiation. Property managers who adapt operations to platform priorities, maintain exceptional quality, and use integrated property management tools to execute consistently across channels will be best positioned for sustained success.

FAQs

Asia-Pacific and Latin America are the engines of growth; both regions delivered double-digit gains. APAC saw mid-teens growth (with markets like Japan and South Korea standing out), and Latin America had high-teens growth (e.g. Brazil leading in new users).

The North American market is now more stable and mature — it’s growing, but modestly. For hosts there, the emphasis should shift toward improving listing quality, guest experience, dynamic pricing, and differentiation to maintain competitiveness.

Yes. On Booking.com, short-term/alternative accommodations now make up 36% of nights and the segment continues to grow strongly, clearly outpacing traditional hotels for the eighth consecutive quarter.

They should tailor their approach by region — leverage growth markets (like APAC & LATAM) by scaling supply and using revenue-management tools; in mature markets, prioritize quality, guest satisfaction, and differentiation. Also, adopt tools for multi-channel distribution, dynamic pricing, automation, and cross-platform analytics — since each OTA values different metrics (e.g. guest reviews, loyalty programs, conversion).