Built-in transactions. Real-time reports. Complete financial oversight.

Accelerate processing

Automate transaction capture and reconciliation for faster processing, improved cash flow, and stronger security. No manual entry required.

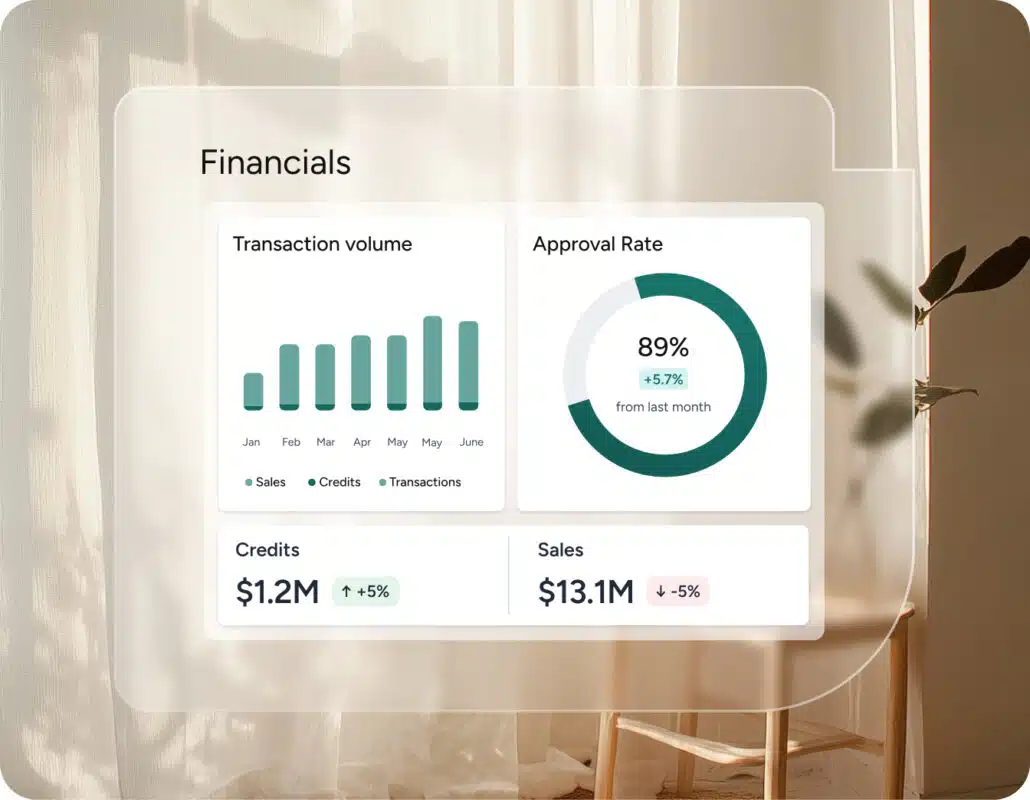

Monitor in real-time

Spot trends, identify risks, and optimize revenue with instant visibility and detailed insights on fees, payouts, and payment history.

Access expert support

Receive specialized guidance from in-house, human experts throughout onboarding, settlements, disputes, and compliance.

Transactions, security, and expense control all in one place

Guesty Pay™

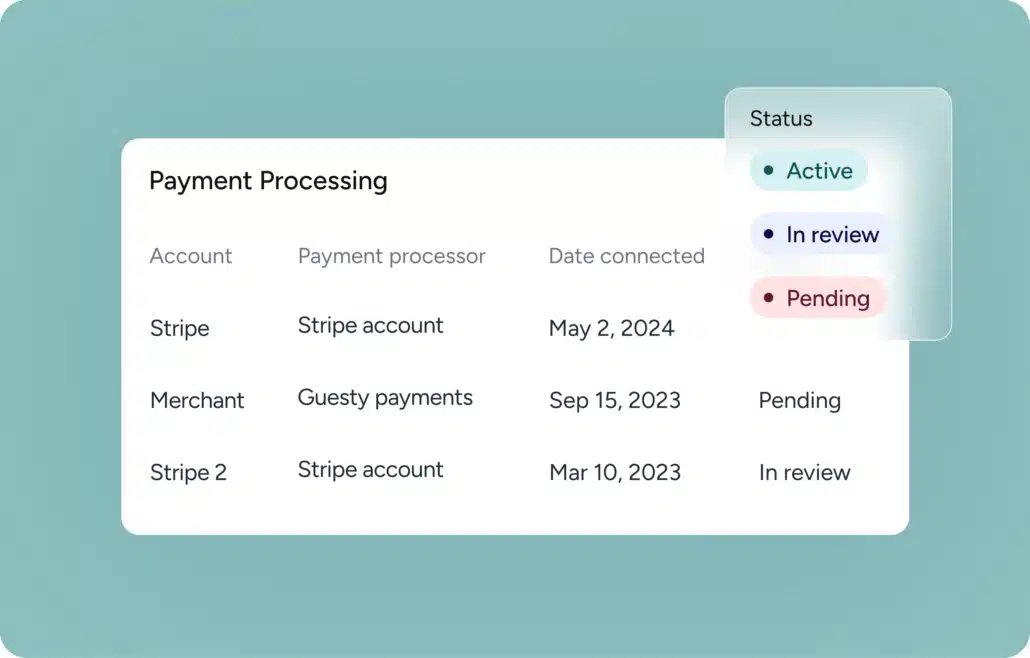

Centralize all payment processing with end-to-end card verification, real-time reporting, rich insights, and secure transactions every time.

Guesty Pay Protect™*

Protect your revenue from frequent chargebacks with AI-powered fraud detection that flags unauthorized transactions at the reservation level across OTAs and direct bookings.

GuestyCard™

Apply for fast credit** lines, monitor expenses in real-time, and allocate team spending with custom budget controls, all built directly into your platform.

Finally, payment processing built for hospitality

Guesty Pay addresses the unique challenges of STR operations, from frequent deposit refunds and chargeback headaches to third-party scrutiny and complex compliance regulations.

FAQs

Many providers don’t understand STR operations, which can lead to unnecessary account holds or confusion around common practices like guest refunds for security deposits. Guesty Pay Suite is purpose-built for this industry, handling payments, deposits, and cancellations without disruption or mismatched provider logic.

Guesty Pay centralizes all payment operations inside the Guesty dashboard, from booking to payout. It automates transaction verification, streamlines processing, and delivers real-time payment reporting, saving you time and keeping funds flowing smoothly.

Yes. Guesty Pay Protect is AI-powered and trained on travel-specific data. It proactively blocks fraudulent and suspicious transactions across OTA and direct bookings and use different tools to stop fraud before it affects your bottom line.

With GuestyCard, you can issue virtual and physical cards, set team spending controls, and track expenses in real time. You can also apply for credit lines directly through Guesty, based on your payment history, with a streamlined process and fast approvals.

Guesty Pay Protect is available only to Guesty Pay users. GuestyCard, however, is available to all Pro and Enterprise users within specific regions, no Guesty Pay activation required.

No. While some third-party elements (like payment iframes) are part of the flow, the Guesty Pay Suite is fully embedded and managed from the Guesty dashboard, so there’s no need to juggle separate portals for processing, monitoring, or reconciliation.

Every transaction is supported by Guesty’s in-house payment experts. From onboarding and settlements to disputes and compliance, you get hands-on help from real humans who understand your STR business model.

* Guesty Pay Protect is only available to Guesty Pay users.

** Your business performance is used and periodically reviewed to assess qualification for initial credit and future credit increases. If eligible, you will have the option to accept any future increases.