The second quarter of 2025 revealed a travel industry walking a thin line between resilience and regional uncertainty, as major online travel agencies delivered solid results while confronting divergent consumer behaviors across key markets. Despite global economic headwinds, Airbnb, Booking.com, and Expedia all exceeded expectations on key metrics, yet their earnings painted a nuanced picture of an industry adapting to shifting travel patterns and evolving platform strategies.

While all three platforms reported positive room nights trends, the underlying trends tell a more complex story. North America experienced more measured growth patterns across all OTAs, with the region showing signs of market maturation rather than expansion. Booking and Expedia reported that US consumer behavior reflected a more cautious travel approach through shorter stays, compressed booking windows, and heightened price sensitivity; trends that, while presenting near-term headwinds, also indicate a stabilizing market environment. Meanwhile, international markets (particularly Asia and Latin America) demonstrated robust momentum that complemented the steadier North American base.

Read Guesty’s industry pulse report.

Q2 2025 landscape: Steady growth amid geographic divergence

The major OTAs demonstrated remarkable consistency in their core growth metrics, yet regional performance variations revealed significant strategic implications for property managers.

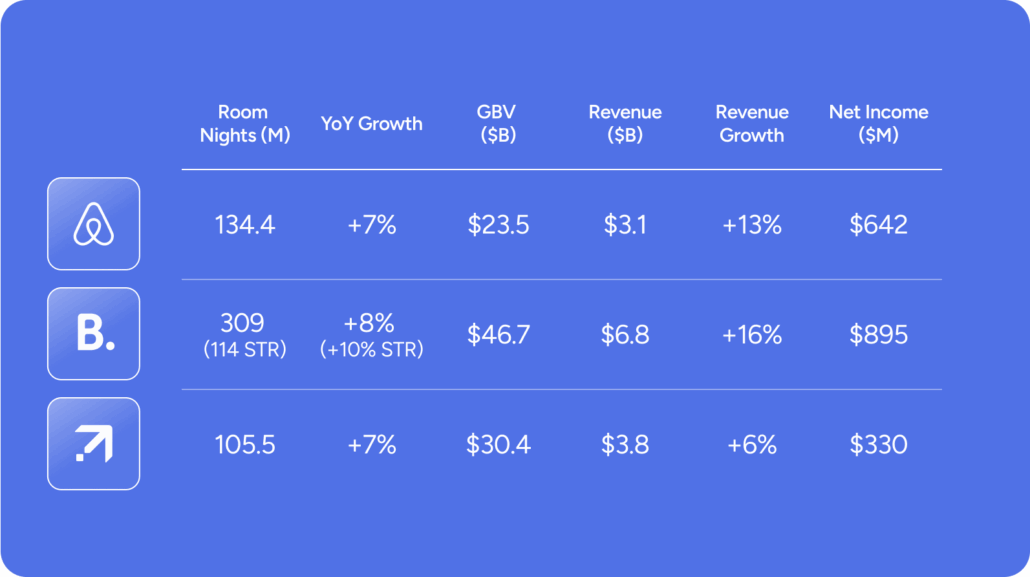

Unified growth momentum masks regional disparities. All three platforms delivered room night growth of 7-8% year-over-year, with Airbnb reaching 134.4M nights, Booking.com achieving 309M total nights (114M STR), and Expedia recording 105.5M nights (including STRs and hotel nights across all brands). However, this aggregate strength masked regional disparities, as Asia and Latin America drove outperformance.

Airbnb: Platform expansion drives strategic transformation

Airbnb’s Q2 results showcased a company in strategic transition, balancing core accommodation growth with ambitious expansion into the broader travel ecosystem.

Geographic momentum concentrated in expansion markets. International regions significantly outperformed North America, with Latin America achieving high-teens growth (Brazil +30% in first-time bookers), APAC delivering mid-teens growth (Japan domestic nights +20%), and EMEA posting mid-single digit growth. Management emphasized that booking behavior remained “consistent year-over-year,” in the US, contrasting with competitors’ reports of shifting US consumer patterns.

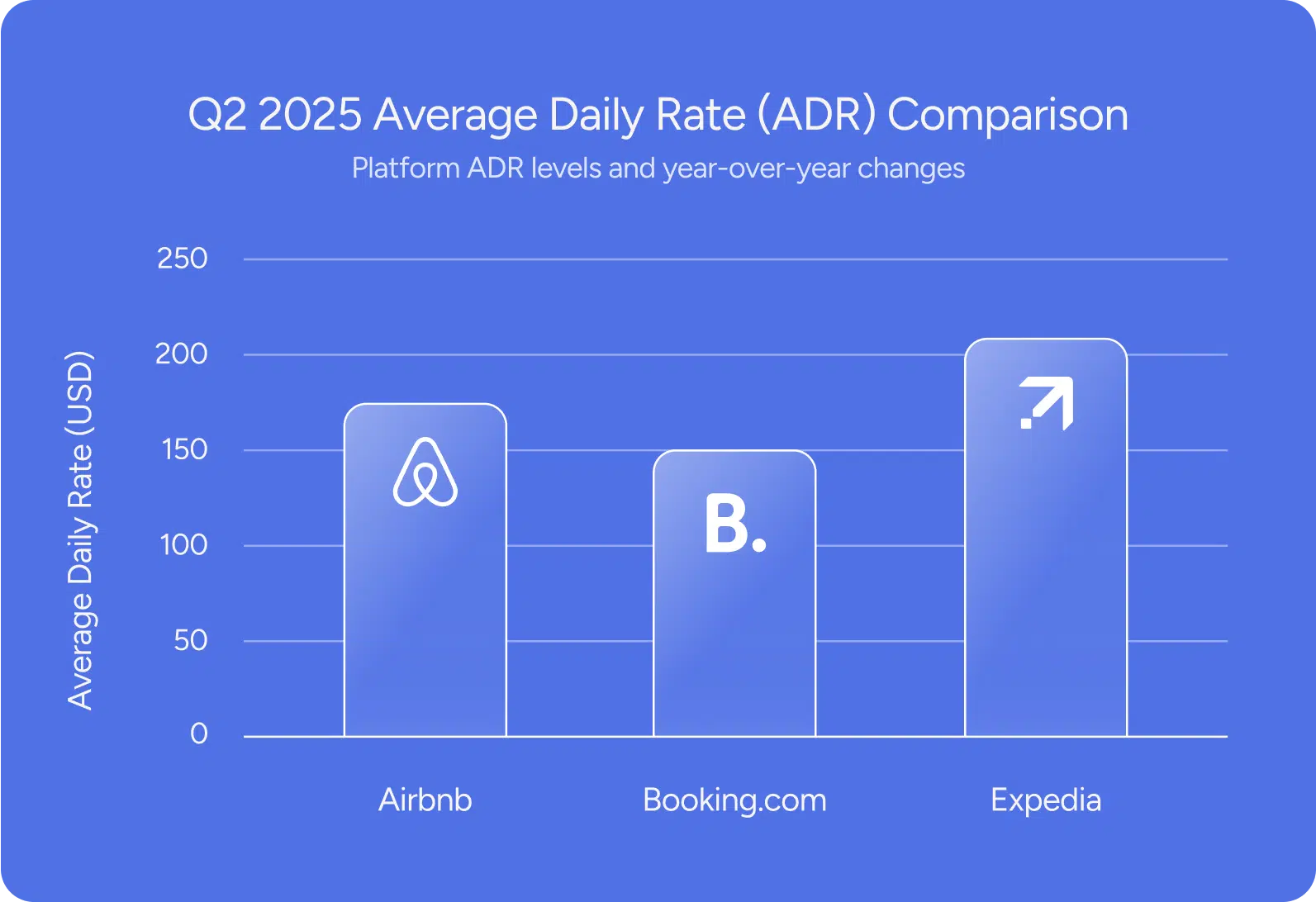

Pricing dynamics reveal mixed regional trends. Average daily rate (ADR) increased 3% year-over-year to $174, driven primarily by foreign exchange tailwinds and price appreciation across all regions. However, the performance varied significantly by market: North America saw a 3% ADR increase primarily from a mix shift toward short-term stays and entire homes, while Latin America experienced a 3% decline due to FX headwinds (though up 2% on constant currency basis). These pricing trends reflect both currency fluctuations and evolving demand patterns that property managers should factor into their pricing strategies.

Supply growth outpaces demand with quality focus intensifying. Active listings are growing faster than bookings, indicating more competition as supply outpaces demand on the platform. Airbnb’s quality initiatives show measurable impact for property managers: over 400 million nights have been booked at Guest Favorite listings since launch, and Superhost-managed properties saw nights booked increase 12% year-over-year. The platform’s removal of 500,000 low-quality listings since 2023 has reduced customer service issue rates and chargeback rates, suggesting that maintaining high property standards directly correlates with operational benefits for hosts.

Booking.com: Connected Trip strategy gains traction

Booking.com’s Q2 performance highlighted success in expanding beyond accommodations while maintaining core hotel business leadership.

Alternative accommodations continue outpacing total growth. STR nights grew 10% year-over-year to 114M, representing 37% of total nights booked (up 1 percentage point from Q2 2024). With 8.4M alternative accommodation listings (+8% YoY), Booking.com’s alternative accommodations segment continues to demonstrate strong growth momentum across both supply and demand metrics.

Connected Trip vision shows measurable momentum. Connected Trip transactions grew over 30% year-over-year and now represent a low double-digit percentage of total transactions. Flight bookings increased 44% to 16M tickets, while attraction bookings more than doubled, demonstrating travelers’ increasing willingness to book multiple trip components through a single platform.

Regional performance reflects global diversification strength. Asia delivered low double-digit growth, Europe achieved high single-digit growth, while the US posted low single-digit growth. Management noted that US consumers showed “more careful spending” with lower ADRs, shorter length of stay, and compressed booking windows, contrasting with European travelers who are “booking earlier at higher prices.”

Expedia: Operational efficiency drives strategic transformation

Expedia’s Q2 results demonstrated operational discipline while highlighting ongoing challenges in its core vacation rental platform.

Vrbo implements product enhancements while navigating market dynamics. Management highlighted several product improvements that went live during the quarter, including last-minute deals, multiunit supply additions, and improved merchandising features. These enhancements have begun showing conversion improvements, though the platform continues working to rebuild traffic momentum in an environment where US travelers are demonstrating more cautious booking patterns with “lower daily rates, shorter stays, and higher cancellations.”

Alternative accommodations strategy expands beyond Vrbo. Management emphasized that Expedia and Hotels.com also offer alternative accommodations, presenting additional distribution opportunities for property managers beyond the traditional Vrbo channel. This multi-brand approach creates more touchpoints for hosts to reach different traveler segments, suggesting property managers should consider diversifying their presence across Expedia’s full portfolio of brands to maximize exposure and booking potential.

B2B business provides consistent growth engine. B2B revenue grew 15% year-over-year, marking the 16th consecutive quarter of double-digit growth. Asia Rapid API was highlighted as a particular standout, with B2B bookings in Asia growing approximately 30%, demonstrating the strength of Expedia’s technology infrastructure for enterprise clients.

Regional analysis: International markets drive momentum

Q2 earnings revealed pronounced geographic divergence with significant implications for property managers’ distribution strategies.

North America experiences moderated growth patterns across platforms. All three OTAs reported North America as experiencing slower growth compared to international markets, with low single-digit growth rates reflecting a more mature market environment and normalized post-pandemic travel patterns. While growth rates have moderated from previous periods, the region continues to represent the largest revenue base for all platforms, providing stability even as expansion accelerates in other regions.

Asia emerges as the standout growth region. Asian markets demonstrated the strongest momentum, with mid-to-low double-digit growth across platforms. Japan specifically showed exceptional performance with Airbnb domestic nights up 20% and Expedia Japan bookings up 20%, while Booking.com’s Asia business benefited from strong inbound tourism to China.

Travel corridor shifts create new opportunities. Booking.com highlighted strong growth in alternative travel patterns, including Canada-to-Mexico and Europe-to-Asia bookings, demonstrating the dynamic nature of global travel flows. While these shifting patterns present opportunities for property managers seeking to diversify their guest base, the reality is that most North American hosts continue to thrive on domestic demand—with 65% of property managers reporting that international travel represents a smaller portion of their overall business compared to domestic guests, according to Guesty’s 2025 industry survey.

Strategic imperatives for property managers in Q2’s evolving landscape

Q2 earnings results reveal several critical shifts that property managers must address to capitalize on emerging opportunities and navigate regional challenges.

Optimize for platform-specific strategic directions. Each OTA’s distinct expansion strategy creates different opportunities:

Airbnb’s Services and Experiences expansion signals broader ecosystem growth. The new offerings create additional revenue streams within Airbnb’s platform, potentially increasing overall guest engagement and platform stickiness. With 40% of Airbnb Originals bookings from locals, this expansion demonstrates demand for local experiences that could benefit properties in urban markets through increased foot traffic and extended guest stays, even though experiences are booked separately from accommodations.

Booking.com’s Connected Trip vision creates opportunities for properties positioned as part of comprehensive travel packages. Property managers should optimize listings for multi-vertical bookings by highlighting proximity to airports, train stations, and major tourist sites with specific distances and travel times, while creating detailed neighborhood guides that showcase how the property serves as an ideal base for exploring multiple local attractions and experiences.

Adapt pricing strategies to regional performance disparities. North American properties should implement more aggressive pricing strategies to combat documented consumer caution, including dynamic pricing tools that respond quickly to demand fluctuations and increased cancellation rates.

International market properties, particularly in Asia and Latin America, can potentially maintain premium pricing given strong growth momentum, while European properties benefit from travelers booking earlier at higher prices.

Leverage AI and automation for competitive advantage. All three OTAs are investing heavily in AI capabilities that reshape the booking experience. Property managers should optimize listings for AI-powered search systems through comprehensive descriptions and high-quality photos, while investing in automated messaging systems to meet evolving guest expectations for faster responses.

Q2 2025’s results demonstrate that while the travel industry maintains its fundamental growth trajectory, success requires increasingly sophisticated strategies that account for platform-specific directions, regional performance variations, and evolving consumer behaviors.

As global travel trends shift and platforms broaden their offerings, property managers who rely on Guesty’s unified solutions to stay agile and deliver exceptional service will be best positioned to thrive in this changing market.