As we move through 2025, the travel industry is experiencing a notable shift in dynamics, with regional disparities and changing consumer behaviors reshaping the short-term rental landscape.

The Q1 earnings reports from Airbnb, Booking.com, and Expedia reveal a complex picture: while global growth continues, we’re seeing significant variations across regions, with North America showing slight signs of weakness. Meanwhile, Airbnb’s bold expansion beyond accommodations could signal some new directions for the industry. This analysis explores how these developments impact property managers and what strategies will prove most effective in this evolving environment.

Q1 2025 landscape: Regional divergence and shifting travel patterns

The first quarter of 2025 presents a nuanced picture of the travel market, with international destinations continuing to gain momentum.

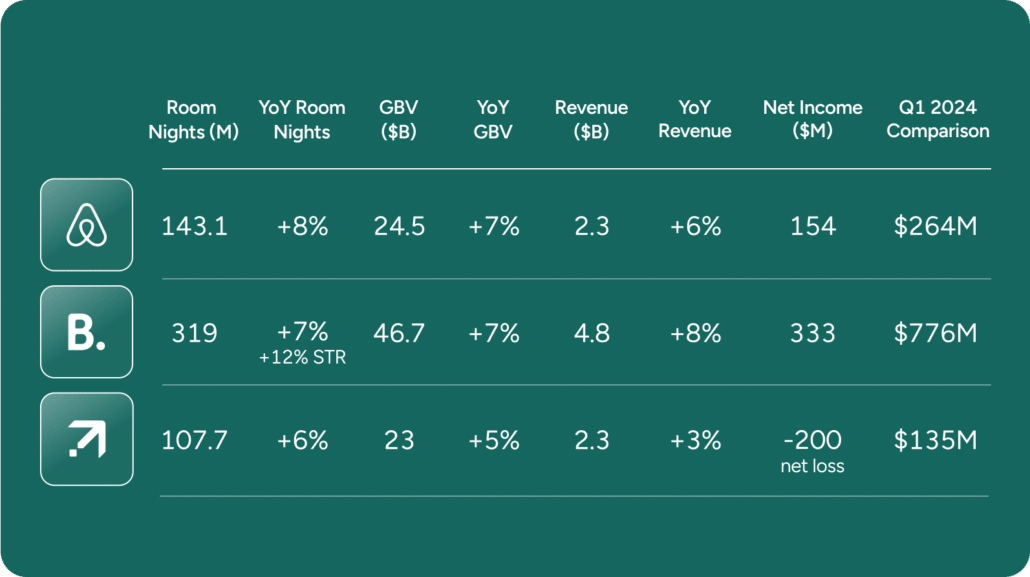

Growth metrics reveal geographic shift. The major OTAs continued to post positive results, though with notable regional variations: Airbnb reported 143.1M nights (+8% YoY), Booking.com recorded 319M total nights (+7% YoY) with STR nights growing faster at 12%, and Expedia hit 107.7M nights (+6% YoY). Robust performance in international markets continues, in parallel with more modest growth in North America.

Pricing trends signal market evolution. Average daily rates showed mixed results, with currency fluctuations masking underlying trends. Airbnb’s ADR declined 1% YoY to $171 but grew 1% when adjusting for currency exchange rate effects, while Expedia saw a similar pattern. These figures suggest that while pricing power remains intact in most regions, property managers should monitor for increasing price sensitivity.

US travel headwinds raise strategic questions. All three platforms noted some degree of softness in US travel, due to current economic uncertainty. Most concerning was Expedia’s report of a 7% decline in inbound travel to the US, with Canadian bookings to the US plummeting nearly 30%. This regional dynamic has created distinct winners and losers, with European and Canadian travelers shifting from US destinations to Latin American ones – a trend property managers should factor into their marketing strategies.

Airbnb’s expanding vision: From accommodations to complete travel ecosystem

The biggest story from Airbnb’s Q1 report isn’t just in the numbers but in the company’s ambitious strategic pivot that dramatically expands its scope in the travel market.

International markets fuel growth: While North America showed low single-digit growth with some fluctuations since January, other regions delivered impressive results:

- LATAM: Low-20% growth rate with Brazil standing out at +30% YoY in first-time booker growth

- APAC: Mid-teens percentage growth with Japan’s domestic nights surging 20% YoY

- Emerging markets: Growth more than doubled that of core markets (US, Canada, UK, France, Australia)

Mid-May summer release marks transformative expansion. In a significant strategic shift, Airbnb unveiled an ambitious platform expansion beyond accommodations:

- Airbnb Services: A marketplace of vetted service providers across 10 categories (chefs, photography, massage, etc.) in 260 cities

- Airbnb Experiences: A reimagined experiences platform in 650 cities with enhanced vetting processes and exclusive “Airbnb Originals” featuring notable personalities

- All-new integrated app: A completely rebuilt platform on a new tech stack that seamlessly connects homes, services, and experiences

Quality focus intensifies. Airbnb continues to prioritize quality, having removed over 450,000 substandard listings since 2023. Nights booked at Superhost-managed properties increased 15% YoY in Q1, and the new AI customer service tool (now used by 50% of US users) has reduced human support needs by 15%.

Hotel strategy emerges alongside core business. CEO Brian Chesky signaled a stronger push into the hotel space, noting plans to “bring more great hotels onto Airbnb” to fill network gaps in urban areas where Airbnbs are often fully booked. This multi-pronged expansion reveals Airbnb’s ambition to become a comprehensive travel platform rather than just an accommodations marketplace.

Booking.com: Alternative accommodations lead the charge in balanced growth strategy

While the overall travel market shows mixed signals, Booking.com’s Q1 results highlight the continued outperformance of short-term rentals within their diversified portfolio.

STRs continue to outperform in portfolio mix. Alternative accommodations remain a standout performer for Booking.com, with STR nights growing 12% YoY compared to 7% overall growth. The 118 million STR nights now account for 37% of all bookings (up 1 percentage point YoY), and supply grew 9% to reach 8.1 million properties across all major regions.

Geographic diversification proves strategically valuable. Booking.com’s balanced global footprint is providing resilience amid regional fluctuations:

- Europe and Asia: High single-digit growth

- Rest of World: Low double-digit growth

- US: Low single-digit growth with signs of a “bifurcated economy” (higher-star properties outperforming lower-tier accommodations)

Connected travel strategy gaining traction. The company’s efforts to expand beyond accommodations showed impressive results, with connected transactions growing over 35% and representing a high single-digit percentage of total bookings. Flight tickets increased 45% YoY, while attraction tickets nearly doubled, growing 92%. A new partnership with Uber will further enhance dining and transportation integration.

AI implementation drives operational improvements. Booking.com is actively testing multiple AI-powered features, including smart filters, property Q&A, and AI review summaries. The company has also launched KAYAK.AI as a test lab for AI-first features and secured partnerships with major tech platforms including OpenAI, Microsoft, and Amazon to accelerate innovation in this space.

Expedia Group: US travel headwinds prompt strategic recalibration

Expedia Group faced the most challenging quarter of the major OTAs, with its heavy exposure to the US market creating headwinds as American travel patterns shift.

US travel softness creates significant drag. With approximately two-thirds of its business coming from the US market, Expedia was disproportionately affected by weakening domestic demand:

- Inbound travel to the US declined 7% overall

- Canadian travel to the US plummeted nearly 30%

- Europeans redirected travel from the US to Latin American destinations

- Hotels.com “slipped back into negative territory” after previous growth

Vrbo stabilization continues amid hotel-led growth. Expedia’s overall GBV increased 5% to $23B, with hotels (+6%) driving growth while Vrbo “grew modestly for the third consecutive quarter.” Nearly one-third of Vrbo’s growth came from multi-unit inventory added last year, highlighting the importance of strategic supply acquisition.

Consumer price sensitivity emerges in booking patterns. Expedia noted early warning signs of changing consumer behavior, including:

- Shift from refundable to non-refundable rate plans

- Increasing hotel partner discounting activity

- Slightly declining booking windows for vacation rentals

Three-pronged strategy addresses market challenges:

- Delivering enhanced traveler value: Improving Vrbo’s product quality, enhancing loyalty programs (which saw mid-single-digit growth in active members), and implementing AI features including Trip Matching via Instagram

- Targeting growth opportunities: Focusing on multi-item trips with record insurance attach rates and new supply partnerships

- Driving operational efficiency: Restructuring 4% of workforce, reducing contractor population by 7%, and deploying AI across departments

Strategic imperatives for property managers in a changing landscape

Q1 2025’s earnings reports reveal significant shifts in the travel ecosystem that demand thoughtful responses from short-term rental operators. Here are the key strategies to consider:

Rethink geographic targeting based on emerging travel corridors. The pronounced shift away from US-inbound travel towards Latin America and continued strength in APAC creates opportunities for property managers to realign marketing efforts. Consider:

- Updating property listings with local cultural references that resonate with domestic travelers

- Tailoring amenities to the preferences of European, Japanese, and Brazilian travelers

- Adjusting cancellation and flexibility policies to accommodate longer booking lead times from international guests

- Exploring partnerships with “Summer Release” vetted service providers to create bundled offerings

Capitalize on quality-driven platform algorithms. All three OTAs are doubling down on quality metrics to determine listing visibility:

- Focus on achieving and maintaining Superhost status on Airbnb (properties with this designation saw 15% YoY growth)

- Invest in professional photography and detailed amenity descriptions that align with AI-driven search improvements

- Monitor and respond promptly to guest reviews and messages to maintain high ratings that platforms increasingly prioritize

Adapt pricing strategies to emerging consumer behaviors. Potential indications of price sensitivity in the US market suggest the need for thoughtful adjustments:

- Implement smart dynamic pricing that can detect and respond to regional demand patterns

- Consider offering strategic discounts for longer stays to maintain occupancy as consumers potentially reduce travel frequency

- Test different pricing tiers and cancellation policies to find the optimal balance between flexibility and rate

Leverage multi-channel distribution with platform-specific optimization. Each OTA is developing unique strengths and user bases:

- Airbnb: Position for its expanding services and experiences marketplace

- Booking.com: Optimize for its growing connected travel ecosystem and loyalty program

- Expedia/Vrbo: Focus on multi-item trips and loyalty program integration

Embrace AI tools for operational efficiency. As all three OTAs invest heavily in AI capabilities, property managers should:

- Test AI-powered messaging tools to improve response times

- Use data analytics to identify emerging booking patterns and adjust strategies accordingly

Looking at Q2, the major OTAs present varying degrees of optimism that mirror their geographic exposure. Airbnb projects the strongest growth at 9-11% revenue increase, driven by international momentum that offsets US softness. Booking.com forecasts a moderate 4-6% growth in nights, emphasizing its geographic diversification as a buffer against regional fluctuations. Meanwhile, Expedia, with its heavy US focus, offers the most conservative outlook at 2-4% gross bookings growth. These projections suggest the regional divergence pattern will persist, with international markets likely to continue outperforming North America through the second quarter.

As travel patterns continue to evolve across regions and platforms expand their ecosystems, property managers who harness Guesty’s integrated tools to adapt quickly while maintaining service excellence will capture the greatest share of this shifting market