If you’re starting to host on Airbnb — whether it’s a private room, a vacation home, or a small rental portfolio — you’ve likely wondered if you need a business license to run an Airbnb. In many cases, the answer is yes. But the exact requirements depend heavily on your local laws, and not having the right license can lead to serious consequences, including fines, delisting, or even legal action.

This guide will help you understand:

- When a business license is required

- The types of permits and licenses you might need

- How to apply for them step-by-step

- What happens if you skip this step

- Global regulations in major Airbnb markets

Let’s break it all down.

1. Is an Airbnb business license required?

Yes. Most cities treat short-term rentals like a business, especially if you’re earning consistent income through platforms like Airbnb. That means in many locations, you are legally required to hold a business license to operate.

This isn’t just a formality. Business licenses allow local governments to:

- Track who is operating short-term rentals

- Enforce zoning and land-use rules

- Collect lodging or tourism taxes

- Protect long-term housing supply

- Ensure safety and accessibility standards are met

That said, the requirements can range from simple online registration to multi-step approval processes, depending on:

- Your city, county, or region

- Whether the listing is your primary residence

- How often you rent it out (number of nights per year)

- Whether you rent an entire property or just a room

Some cities may also have host caps, night caps, or limitations based on neighborhood or housing type. And in some regions, Airbnb will prompt you to enter your business license number directly into the platform before your listing can go live.

Common triggers that require a business license

Local governments generally require you to apply for a business license if your Airbnb activity includes:

- Renting your property for more than 14–30 days per year

- Operating on a consistent or recurring basis with the intent to generate profit

- Renting out a unit while not living there full time (unhosted stays)

- Advertising on short-term rental platforms like Airbnb, Vrbo, or Booking.com

- Earning above a specific gross rental income threshold (varies by city/state)

Even if you consider yourself a hobbyist host or rent occasionally, local laws may still define your activities as commercial, especially if money changes hands.

Some cities also distinguish between hosted and unhosted stays — meaning whether or not you’re physically present during the guest’s visit. Unhosted listings often face tighter rules and stricter permit requirements.

Real examples:

- In Los Angeles, you must register for a Home-Sharing License if you host Experiences or Trips for seven days or more (or even fewer if you’re using or leasing property to operate). In these cases, the city considers you to be running a business and requires you to register. This applies whether you’re offering the Experience full-time or just part of the year.

- In New York City, most Airbnb Experiences don’t require a business license. However, if you hire employees or sell physical goods as part of your Experience, you may need to register with the New York State Department of Taxation and Finance for a Sales Tax Certificate of Authority. This is especially relevant if your activity qualifies as a retail business.

- In France, you are likely considered a business if you operate on a regular basis with intent to profit, regardless of your main profession. If so, you must register with the appropriate Centre de Formalités des Entreprises (CFE). There are several business structures available, including micro-entrepreneur status for small-scale operators.

If you’re unsure, start by checking with your city or municipal website. Many jurisdictions now have dedicated sections on “short-term rental regulations” or “Airbnb business licensing.” Airbnb also provides local regulation resources that you can search by city or region.

When in doubt, check your local laws — don’t assume you’re exempt. Even if Airbnb doesn’t ask for a license when you create your listing, your city might. It’s your responsibility to comply.

Which permits or registrations might you need as an Airbnb host?

If your city or municipality requires you to obtain a license, you’ll likely need one or more of the following permits depending on where and how you operate:

1. General business license

This is the most basic requirement for any revenue-generating activity. It registers your Airbnb operation as a legitimate business in your city or county. You’ll typically apply online or in person with your local business registration office.

2. Short-term rental permit

Many cities have a permit specifically for short-term rentals (STRs). This permit ensures compliance with:

- Local housing regulations

- Nightly rental limits

- Residency requirements (e.g., must be your primary home)

- Health and safety inspections

Example: San Francisco, Austin, and Portland all require STR permits with specific rules on how many nights you can rent annually.

3. Zoning permit or clearance

Zoning laws control how properties can be used in specific neighborhoods. Some areas prohibit STRs altogether or restrict them to certain zoning designations. Before listing, check if short-term rentals are allowed in your property’s zoning classification.

4. Tax registration (sales, lodging, or tourist tax)

Many cities and states require hosts to collect and remit taxes, including:

- Transient occupancy tax (TOT)

- Sales tax

- Tourism tax

Some of these may be collected and remitted by Airbnb automatically, but in other locations, you’re responsible for registering and submitting these taxes yourself.

5. Health and safety inspection certificates

In some jurisdictions, before you receive a license or permit, your property must pass inspections related to:

- Fire alarms and extinguishers

- Emergency exits

- Carbon monoxide detectors

- Sanitation and cleanliness

These inspections may be required annually or at the time of initial application.

How to apply for an Airbnb business license

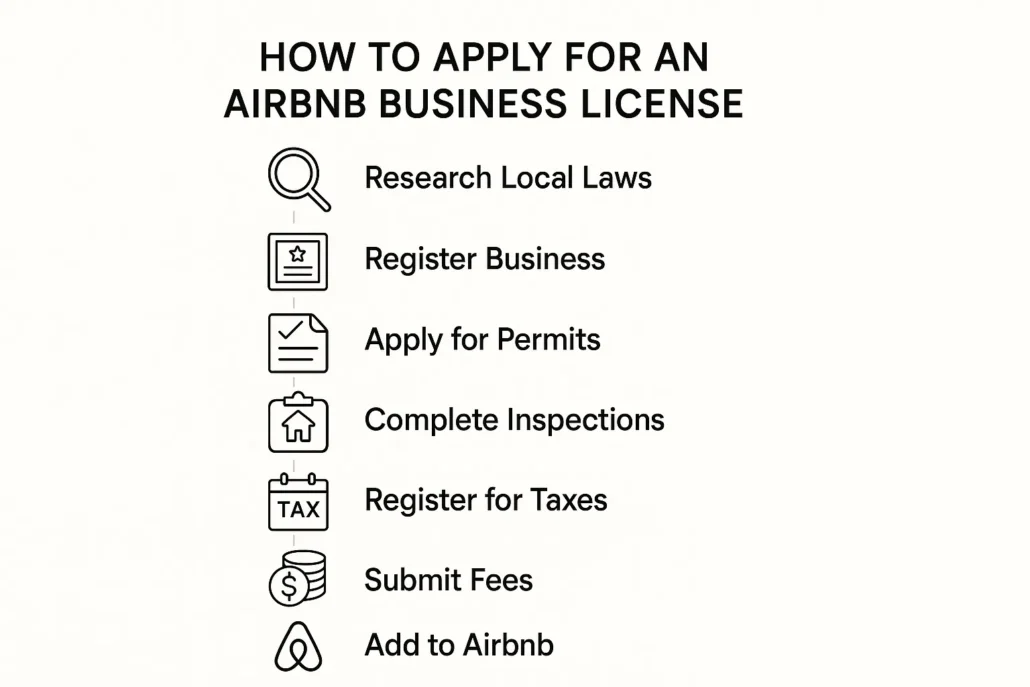

Once you’ve identified the required permits, here’s a step-by-step process most hosts will follow:

Step 1: Research your local laws. Visit your city or county’s official website. Look for the business licensing or short-term rental section. It will outline whether you need a business license, STR permit, or additional registrations.

Step 2: Register your business. If required, apply for a general business license online. You may need to declare your business structure (sole proprietor, LLC, etc.) and submit identification and address documentation.

Step 3: Apply for STR and zoning permits. Complete any STR permit forms, including proof that your home meets local eligibility criteria (e.g., primary residence, not rent-controlled). You may also need a zoning clearance certificate.

Step 4: Complete safety inspections. Schedule a property inspection if required. Install or confirm fire safety equipment (alarms, extinguishers, exits) as outlined by your local agency.

Step 5: Register for tax collection. If local law requires you to collect taxes, register with the city or state revenue office to obtain a sales tax or occupancy tax license.

Step 6: Submit and pay fees. Each license or permit typically comes with a fee. Submit all paperwork along with payment and wait for approval. In some cities, processing can take several weeks.

Step 7: Add your license number to Airbnb. Once approved, go to your Airbnb listing and input your license or permit number in the appropriate section to comply with Airbnb’s listing requirements.

What happens if you don’t comply with Airbnb licensing rules?

Failing to meet local licensing regulations can have serious consequences, including:

- Hefty fines: Ranging from $100 to over $5,000 per violation, depending on the city or infraction

- Delisting: Airbnb may remove or suspend your listing if you fail to provide required permit information

- Legal action: Cities may pursue lawsuits or administrative actions for repeated non-compliance

- Eviction or HOA penalties: If you’re renting in a building or area with rules against STRs, you could face eviction or community fines

- Loss of income: Having your listing suspended or taken down reduces your visibility and potential bookings

To avoid these penalties, always check and follow your local short-term rental regulations. Some cities have appeal processes or grace periods, but enforcement can be strict.

Simplify compliance with Guesty Lite

If you manage 1–3 listings and want to streamline your operations while staying fully compliant with local laws, Guesty Lite is a powerful solution.

Guesty Lite was built for hosts who want to grow sustainably while avoiding manual headaches. It helps with:

- Centralizing license and tax-related documents

- Preventing double bookings through a unified multi-calendar

- Automating guest messaging and check-in coordination

- Syncing reservations across Airbnb, Vrbo, and Booking.com

- Managing your short-term rental like a pro, without needing a large team

Whether you’re just getting started or scaling up your Airbnb business, Guesty Lite provides the structure and tools to simplify daily operations and reduce compliance risks.

In most cases, yes. Many cities treat short-term rentals as a business, especially if you earn consistent income, making a business license a legal requirement in many locations. However, specific requirements vary greatly depending on local laws, your city, and how often you rent your property.

An Airbnb host might need a general business license, a specific short-term rental (STR) permit, a zoning permit or clearance, tax registration (for sales, lodging, or tourist taxes), and potentially health and safety inspection certificates, all depending on local regulations.

Local governments use business licenses to track short-term rental operators, enforce zoning and land-use rules, collect lodging or tourism taxes, protect long-term housing supply, and ensure safety and accessibility standards are met.

Common triggers include renting your property for more than 14–30 days per year, operating on a consistent basis for profit, renting out a unit while not living there full time (unhosted stays), advertising on platforms like Airbnb, or earning above a specific gross rental income threshold.

Non-compliance can lead to severe penalties such as hefty fines (ranging from $100 to over $5,000 per violation), delisting or suspension of your Airbnb property, legal action from the city, eviction or HOA penalties, and a significant loss of income due to reduced visibility and bookings.